So you want to know about the Fair Market Value (FMV) formula? Well, most articles out there typically talk about FMV in relation to properties, but I want to break away from that and talk about FMV in a broader context.

As an entrepreneur or someone in sales, understanding FMV is crucial. It can help you determine the right price for your product or service and ensure that you're not leaving potential profit on the table.

In this article, I'll explain the FMV formula in practice and give you some examples so you can see how FMV can be used to your advantage. So, sit tight, and let's dive into the world of FMV!

Why Does Fair Market Value Matter?

Let's say you're trying to sell something– your grandma's beautiful antique vase she won at bingo back in 1967. You think it's worth a million bucks– and maybe it is– but your potential buyers are only offering you $50 for it. How do you know what the vase is really worth?

Enter the Fair Market Value (FMV) formula. This little trick helps you figure out the sweet spot where you're not getting ripped off and your buyers aren't getting gouged.

Basically, FMV is the price that someone would pay for the vase if they didn't know you and you didn't know them. It's like when you're haggling for a t-shirt at a market. You don't know the seller, and they don't know you, so you're both trying to get the best deal you can.

So, keep FMV in mind when you're trying to set a price for your product or service. It can help you ensure you're not leaving money on the table and that you're not scaring away potential buyers with a price tag that's too high.

However, you should also remember that you aren’t obligated to sell at the FMV price. No, it’s to give you an idea of what the minimum “fair” price would be if the product were sold on the open market without any distinguishing qualities from other products of its type.

The Fair Market Value Formula

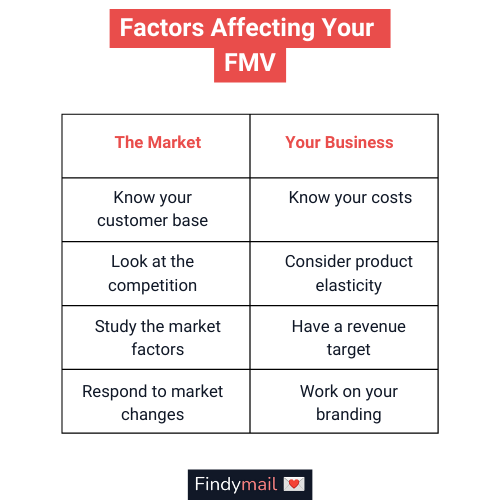

The fair market value formula takes into account a few different factors, such as:

- The current market conditions

- The condition of the item being sold (if physical product)

- The demand for it

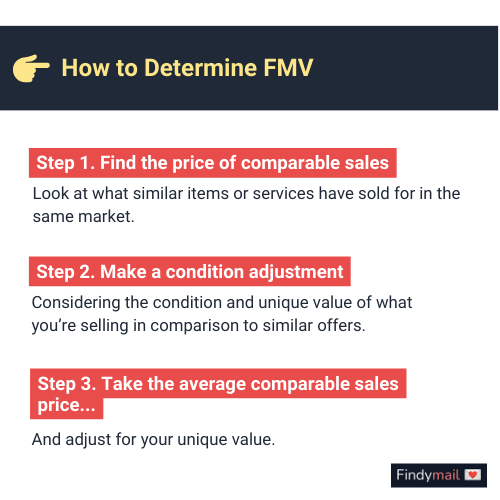

Here's a basic formula I like to use when pricing my products:

FMV = (Price of Comparable Sales + Condition Adjustment) / 2

Let's break it down a bit.

First, you need to find the price of comparable sales. You can do that by looking at what similar items have sold for in the same market.

For example, if you're selling a used car, you would look at what other used cars of the same make, model, and year are going for. (Personally, I look at other cold outreach tools and email finders & verifiers when evaluating Findymail’s pricing.)

Then, you have to make a condition adjustment. This means considering the condition of the item you're selling compared to the other comparable sales.

For example, if your used car has a few dents and scratches and needs a new paint job, you’d need to lower your asking price a bit.

If you’re in SaaS like me, you’re looking at capacity, email finder accuracy, and other details relevant to your niche. For example, I know very few tools scrape Apollo and Sales Navigator while getting accurate email addresses. Since Findymail does that (and competitors don’t), I factor it into the pricing.

Finally, you take the average of the price of comparable sales and the adjusted price for your item, and that gives you a Fair Market Value.

Of course, this is just a basic formula I’ve come up with to simplify the idea. There are many different factors to consider when calculating FMV depending on the item being sold and the market conditions. But, understanding the basic principles behind FMV can help you make more informed decisions when it comes to pricing your product or service.

FMV in Practice

Let’s take a look at what FMV looks like in the real world.

Example 1

Imagine you're about to launch a new SaaS product that helps small businesses manage their inventory. You want to make sure your pricing is competitive but also profitable.

If you want to get the FMV for your SaaS product, you first look at other similar inventory management tools and see that the average price is around $50 per month per user.

However, your SaaS product is badass and offers more advanced reporting and analytics features that boost your clients’ ROI by 20% compared to your competitors, so you adjust the price upwards by 10%.

Now throw the numbers into our formula above, giving you the FMV of $55 per month per user. That way, you can be confident that your pricing is competitive but also reflects your product's added value. Plus, it’s a fantastic addition to your sales plan and negotiation arsenal.

Fair Market Value keeps you in check when evaluating how much profits you could realistically earn with your product or service.

Example 2 of the Fair Market Value Formula in Practice

Now, let's say you're a venture capitalist considering acquiring an established SaaS product that helps businesses manage their customer relationships.

You want to make sure you're getting in on it at a fair price– you guessed it, we’re going to calculate the FMV.

First, you’ll take a look at the company's financial statements, which show that they generated $1 million in revenue last year and had $500,000 in expenses. You then research the valuations of comparable SaaS products and find that the average valuation multiple is around 5x the revenue.

Using this valuation multiple, you calculate the FMV of the product to be $5 million. Here, we’re looking at the company’s revenue and current market conditions to determine what’s a “fair” price.

As mentioned, several factors go into determining FMV, but this gives you a basic understanding of how it works and how you can apply it to your product/service.

Wrapping Up

I hope this article has helped you understand the Fair Market Value formula a little better!

Whether you're pricing a new SaaS product, Beanie Babies (anybody remembers those?), or want to ensure you aren’t getting ripped off on a used car, the FMV can help you ensure the price is fair to everyone involved.

And remember, the FMV formula isn't just for properties– it can be used in all sorts of industries and situations. So, the next time you're negotiating a deal or trying to figure out what to charge for your service when talking to a lead, don't forget about the power of the fair market value formula.